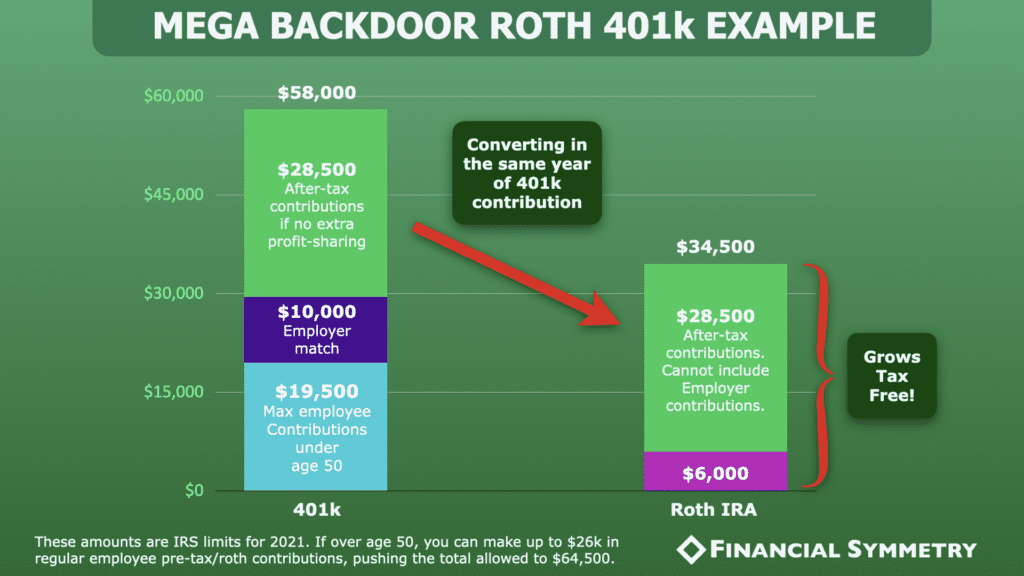

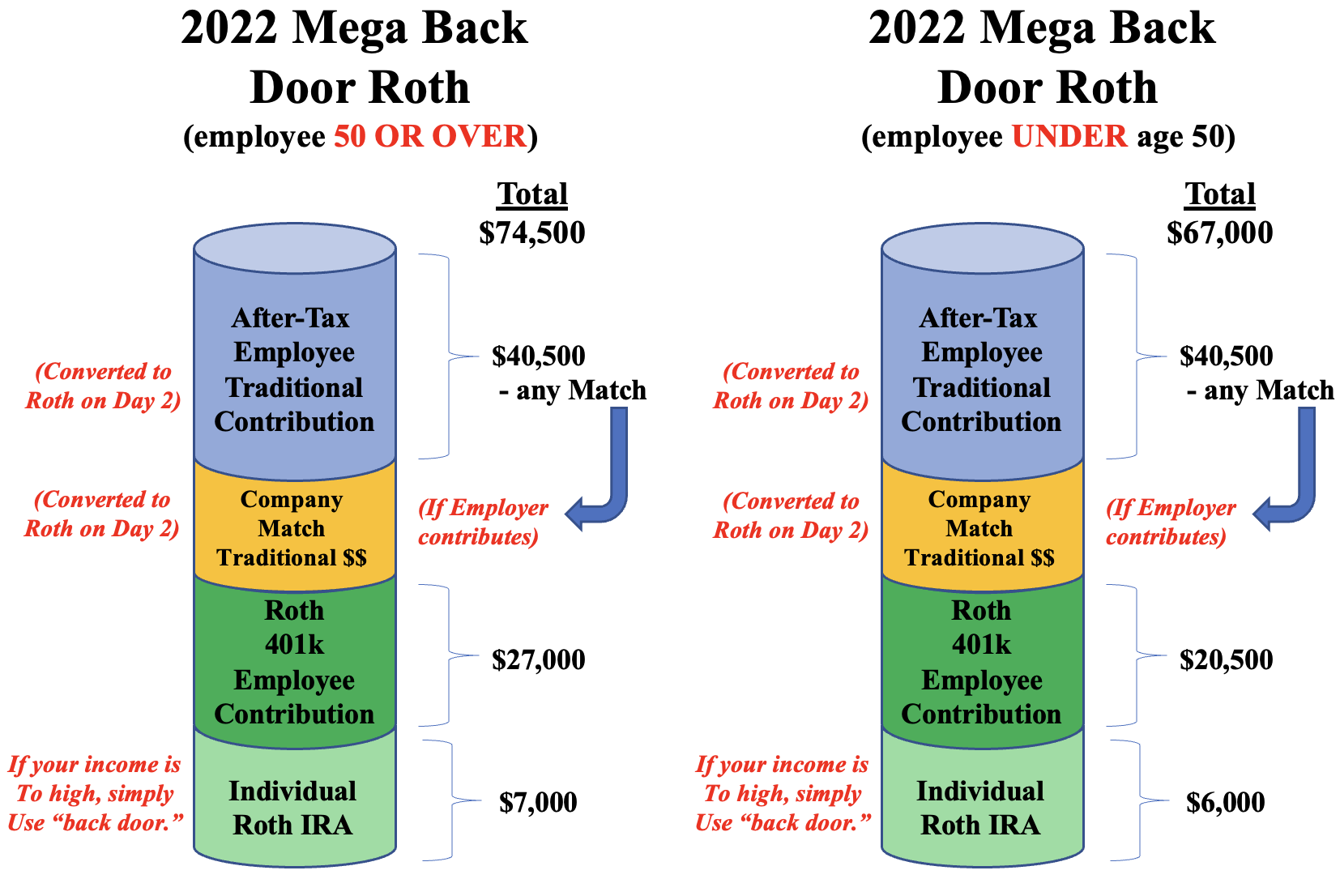

401k Mega Backdoor Roth Limit 2025. And in any case, it. In 2025, the mega backdoor roth strategy allows 401 (k) contributions up to $69,000 for those under age 50 and $76,500 for people 50+.

The annual contribution limit is $7,000 for 2025, plus an extra $1,000 if you’re age 50 or older. It’s even theoretically possible (although rare) to do a mega backdoor roth ira with a 403(b).

401k Mega Backdoor Roth Limit 2025 Allis Bendite, A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira.

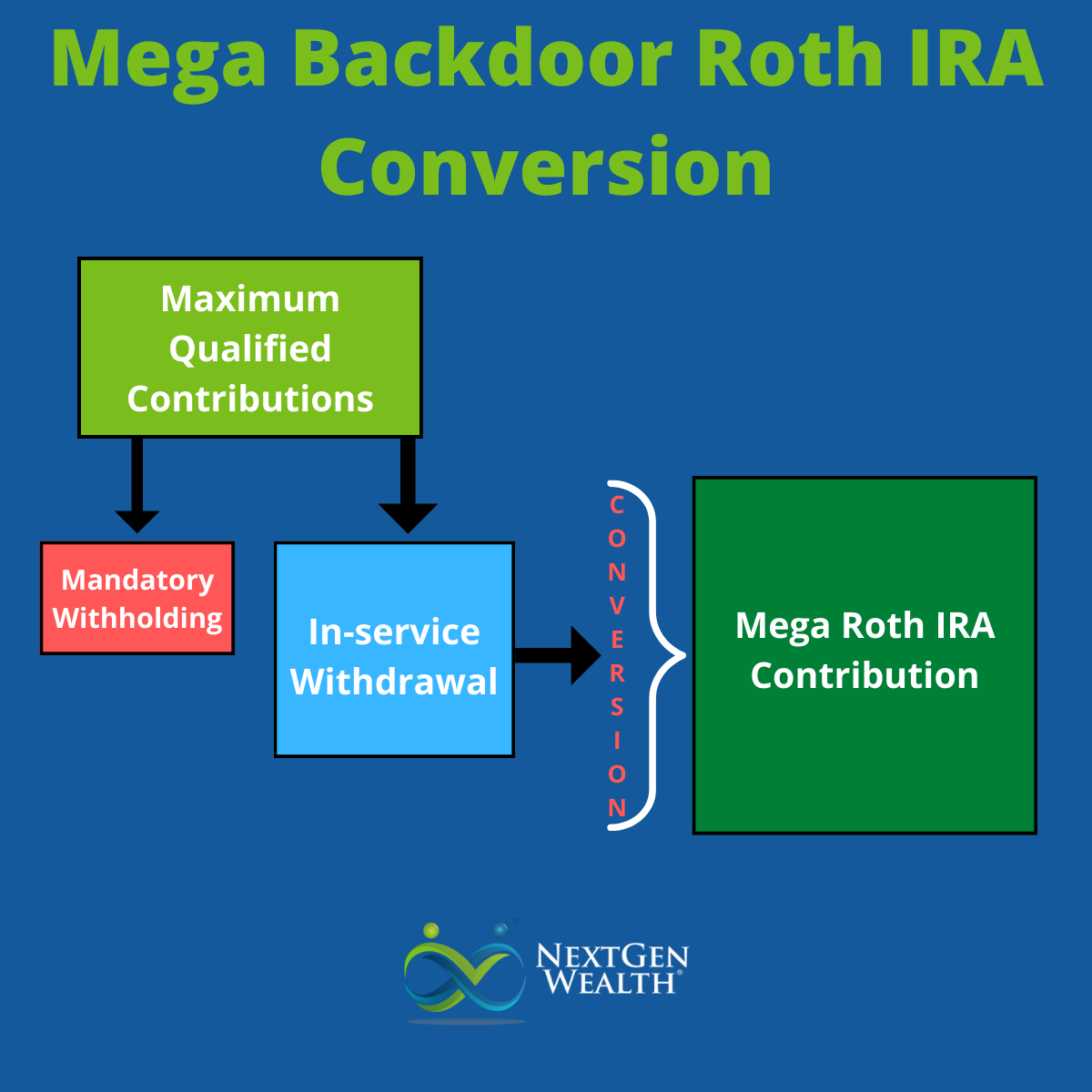

Mega Backdoor Roth Limit For 2025 + How It Works Playbook, Mega backdoor roth conversions are a lucrative tax strategy that allow for additional roth savings within your 401(k) with no upper limit on income eligibility.

.png)

Mega Backdoor Roth Maximum 2025 Janis Rebecca, Mega backdoor roth conversions are a lucrative tax strategy that allow for additional roth savings within your 401(k) with no upper limit on income eligibility.

Backdoor Roth Ira Limits 2025 Joete Madelin, A roth ira is a retirement account for individuals (vs.

2025 Mega Backdoor Roth Limit Dulce Glenine, The contribution limit on individual retirement accounts will increase by $500 in 2025, from $6,500 to $7,000.

Backdoor Roth Limit 2025 Lorie Raynell, This amount is on top of the standard 401(k) contribution limit, which is.

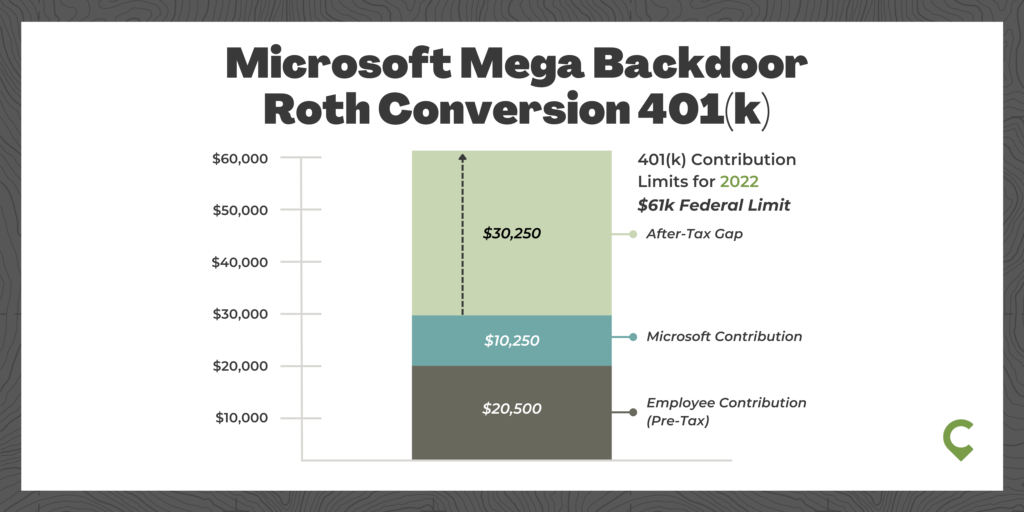

Microsoft Mega Backdoor Roth Conversion Avier Wealth Advisors, How to use a backdoor roth ira.

Maximize Retirement Savings with MICROSOFT 401(k) & Mega Backdoor Roth, You can fully leverage these limits by taking advantage of the mega.